Let’s talk financials — specifically, the two numbers every business owner, investor, and CFO keeps a close eye on: the top line and the bottom line.

These aren’t just entries on an income statement; they represent two distinct facets of your company’s financial health. The top line shows how much money your business brings in, while the bottom line tells you how much of it stays after expenses, taxes, and other costs are accounted for.

Why does this matter? Chasing revenue without safeguarding profits can lead to burnout and financial instability. On the other hand, focusing solely on profitability can stifle innovation and limit growth.

Striking the right balance is key, and with smart accounting tools, it’s easier than ever to monitor these metrics and make informed decisions. On G2, you can compare smart accounting tools to find the right fit for your business needs, whether you’re tracking revenue growth, controlling costs, or optimizing your bottom line.

What is top line and bottom line?

In business terms, the top line refers to your company’s total revenue, while the bottom line reflects your net income after expenses. These financial metrics serve different purposes: one shows how much you’re earning, the other how much you’re keeping. Understanding both helps you improve profitability, optimize growth strategies, and make better long-term decisions.

Whether you’re scaling a startup or steering a mature enterprise, knowing the difference between the top and bottom lines empowers you to set sharper goals, align your team, and drive sustainable success.

In this article, we’ll explain what these two financial markers really mean and how understanding them can unlock your business’s next stage of growth.

TL;DR: Everything you need to know about top line and bottom line

Top line (how much you make/revenue):

- Appears at the top of the income statement.

- Measures a company’s gross income from selling products or services.

- Growth here typically reflects increased sales.

Bottom line (how much you keep/net income):

- Found at the bottom of the income statement.

- What’s left after deducting operating expenses, taxes, interest, etc.

- Indicates a company’s profitability.

Top line vs. bottom line: what’s the real difference?

While both the top line and bottom line are vital indicators of financial health, they measure very different things. The top line shows how much money is coming in, and the bottom line shows how much you actually keep.

Top line growth is typically driven by increased sales, new customer acquisition, or pricing adjustments. Bottom line growth, on the other hand, can result from reducing costs, improving operational efficiency, or optimizing tax strategies, even without increasing revenue.

Take Amazon. In its early years, the company prioritized top growth, investing aggressively in customer acquisition, infrastructure, and global expansion. Profitability took a back seat, but investors stayed confident, drawn to Amazon’s explosive revenue growth as a signal of long-term potential.

Alphabet, Google’s parent company, offers a more recent example. In July 2024, it reported quarterly revenue of $74.6 billion, driven by surging ad sales on YouTube and growing demand for cloud services. This marked a clear success in top line growth, with strong performance across its key business segments fueling its upward trajectory.

Now contrast that with Apple. While its revenue continues to climb steadily, much of its financial strength lies in bottom line excellence — think high margins, disciplined cost control, and massive net income. Apple’s ability to consistently turn revenue into profit is a masterclass in operational efficiency.

FedEx recently demonstrated similar bottom line strength. Earlier this year, the company boosted net profit despite a dip in sales, thanks to improved margins and tighter cost management in its flagship FedEx Express division. Streamlining operations helped lift profitability, proof that a shrinking top line doesn’t always mean shrinking performance.

What is EBITDA, and why does it matter?

EBITDA stands for Earnings Before Interest, Taxes, Depreciation, and Amortization. It’s a financial metric that strips away costs that can vary widely between companies, such as financing decisions (interest), geographic tax structures, and non-cash expenses like depreciation of assets. By doing so, EBITDA provides a clearer view of a company’s core operating performance.

What is top line growth?

Think of it as the raw, unfiltered view of how much money is coming into the business. It sits at the top of the income statement, which is where it gets its name.Top growth refers to an increase in total revenue over a given period. For example, if your company brought in $2 million in sales last year and $2.4 million this year, your topline has grown by 20%. It’s simple in concept, but the implications are far-reaching.

Why top line growth signals business momentum

Top growth is one of the clearest indicators that your business is gaining traction. It can signal higher demand, an expanding customer base, better pricing power, or effective sales and marketing execution. In many cases, it’s the first number stakeholders look at to assess momentum.

For investors, a rising top line is often a strong signal of market opportunity. It suggests product-market fit, successful customer acquisition, and the potential for scaling. For internal teams, it’s a motivator, proof that the business is moving in the right direction.

However, revenue growth alone doesn’t guarantee financial health. A company may be generating record sales while burning through cash even faster. Without disciplined cost management, top growth can mask operational inefficiencies and unsustainable business models. That’s why it’s crucial to also track the bottom line, net profit, alongside it.

How businesses grow their top line

Companies can drive top growth through several strategies, often falling into the categories of sales, marketing, or product-led growth:

- Acquiring new customers through advertising, partnerships, or referrals

- Raising prices on existing products or services

- Expanding product lines or offering premium upgrades

- Entering new markets, either geographically or by targeting new segments

- Improving retention and increasing recurring revenue from existing customers

Each strategy has its trade-offs. While aggressive sales tactics may boost revenue quickly, they can also increase the customer acquisition cost (CAC). Similarly, expanding into new markets may yield growth, but with higher operational complexity.

Top line ≠ success: why profitability still matters

It’s tempting, especially for early-stage companies, to treat top growth as the ultimate success metric. But if you’re spending $1.10 to generate $1 in revenue, that’s not sustainable. Flashy revenue figures can hide weak unit economics, poor retention, or bloated operating costs.

That’s why savvy investors and operators dig deeper. In SaaS and other recurring revenue models, for example, the Rule of 40 combines revenue growth and profit margin to assess financial efficiency. It’s a reminder that growth is good, but efficient growth is better.

What is bottom line growth?

It’s the final figure on the income statement, which is why it’s literally called “the bottom line.” Bottom line growth occurs when a business increases its profitability. This can happen by boosting revenue, reducing expenses, or both. While top growth tends to generate buzz, it’s the bottom line that ultimately fuels long-term sustainability, shareholder value, and business resilience.

Why strong bottom line growth drives sustainable success

Bottom line metrics give a clear view of a company’s true financial health. Two businesses may each earn $10 million in revenue, but if one keeps $2 million in profit and the other only nets $100,000, their efficiency, and likely their valuation, are miles apart.

That’s why CFOs, investors, and founders often focus more on net income than gross sales. A rising bottom line typically indicates:

- Strong cost management

- Improved operational efficiency

- Scalable business processes

- Optimized pricing strategies

- Increased profit leverage as the business grows

For public companies, the bottom line directly influences earnings per share (EPS), a key driver of stock price and investor confidence.

How companies grow their bottom line

Unlike top strategies, which focus on bringing in more revenue, bottom line growth is about maximizing what you keep. It’s the result of smart financial stewardship and operational discipline. Common strategies include:

- Streamlining operations or automating manual processes

- Negotiating better rates with vendors or outsourcing strategically

- Improving gross margins through smarter pricing or sourcing decisions

- Cutting non-essential spending, such as unproductive marketing or excess overhead

- Investing in technology that boosts productivity without inflating costs

Some businesses are able to grow their bottom line significantly without increasing revenue at all. That’s what makes this metric so powerful: it reflects not just how big your business is but also how well it’s run.

The danger of chasing profits without a strategy

While bottom line growth is essential, an overemphasis on profitability can backfire. Aggressive cost-cutting that compromises product quality, employee morale, or customer satisfaction may inflate short-term earnings but hurt long-term viability. Sustainable profitability comes from balancing efficiency with strategic investment, cutting the right costs, not just any costs.

How top and bottom line metrics influence company valuation

Whether you’re raising capital, preparing for acquisition, or simply measuring your company’s worth, both the top and bottom lines significantly influence valuation, but in different ways.

Investors often view top revenue as a signal of market traction and growth potential. A strong and growing revenue stream suggests demand, product-market fit, and scalability. In high-growth industries like SaaS, fintech, or e-commerce, companies are frequently valued using revenue multiples, especially when they’re not yet profitable.

For example, a SaaS startup might be valued at 5× its annual revenue, even if it’s operating at a loss, because its top line is growing rapidly, say 50% year over year. In these scenarios, growth velocity can outweigh current earnings.

The bottom line reflects a company’s actual profitability and cash flow, making it central to how traditional or mature businesses are valued. Sectors like manufacturing, services, or retail often use earnings-based multiples, such as the price-to-earnings (P/E) ratio, to determine value.

A strong bottom line shows that a company runs a lean, efficient operation and can turn revenue into lasting returns. For acquirers or private equity investors, especially those focused on stability and returns, net income is often the defining metric.

In truth, sophisticated investors look at both lines together. A company with fast-growing revenue and expanding profit margins is especially attractive. That’s why hybrid metrics like the Rule of 40, EBITDA margin, and LTV:CAC ratio are so popular; they bridge top momentum with bottom-line efficiency.

Ultimately, valuation is not just about how much money you make or keep; it’s about how efficiently and sustainably you do both.

Which matters more: top line or bottom line?

If you’re wondering whether to prioritize top growth or bottom line strength, the honest answer is that it depends on your goals, stage of business, and operating model.

In the early stages of a company, especially in venture-backed environments, top growth often takes center stage. Investors are looking for traction, market expansion, and the ability to scale. That’s why many high-growth startups are valued using revenue multiples, even if they’re not yet profitable.

Fast revenue growth signals that the product resonates with customers, the market opportunity is real, and the team can execute at scale. Profitability, in this context, is often viewed as something that can come later.

For established companies, the focus typically shifts to the bottom line — profit margins, net income, and cash flow. These metrics reflect operational health and financial sustainability.

Public companies, for example, are judged heavily on earnings per share (EPS) and margin trends. A strong bottom line supports dividends, reinvestment, and stability in economic downturns.

Ultimately, long-term success comes from balancing both. A company that grows the top line without controlling the bottom line risks burning out. One that protects margins but underinvests in growth may plateau or fall behind competitors.

The smartest businesses align revenue ambition with cost discipline, tracking both metrics closely and adjusting strategy based on the company’s stage, market conditions, and growth opportunities.

Top and bottom line mistakes to avoid

Understanding the difference between the top and bottom lines is just the start. The real challenge lies in using that insight effectively. Many businesses, especially during periods of rapid growth or economic uncertainty, fall into predictable traps that distort their financial decision-making.

Here are four of the most common pitfalls:

Mistake #1: Chasing revenue without profitability

One of the most frequent missteps, especially for startups and growth-stage companies, is aggressively investing in sales and marketing to boost top-line revenue without monitoring profitability. If you’re spending $100 to acquire a customer who only brings in $80, you’re not growing; you’re burning cash.

To ensure sustainable growth, always pair revenue growth with metrics like CAC, customer lifetime value (LTV), and contribution margin.

Mistake #2: Cutting costs too deeply

On the opposite end, some companies focus too heavily on boosting their bottom line by slashing expenses. While this may improve short-term net income, it can hurt long-term performance, especially if it means underinvesting in R&D, customer experience, or brand building.

Bottom line growth that weakens your future top line isn’t progress, it’s short-termism.

Mistake #3: Using one metric in a vacuum

Focusing solely on revenue or profit creates a one-dimensional view of your company’s health. For example, rising profit might be a sign of better efficiency or of downsizing. Climbing revenue might mean healthy growth or signal overspending if margins are shrinking. Always analyze both top and bottom lines together to understand the full picture.

Mistake #4: Not tracking trends over time

Top-line and bottom-line metrics are most meaningful over time, not as isolated snapshots. A single quarter’s performance doesn’t reveal much without context. Trends reveal trajectory,whether you’re accelerating, decelerating, or stabilizing. Make trend tracking a core part of your financial dashboard. It’s not just the numbers; it’s where they’re headed.

Tip: Platforms like QuickBooks, NetSuite, and Cube (all highly rated on G2) offer real-time dashboards, automated income statements, and forecasting tools that make it easier to monitor revenue, control costs, and project profits. Explore top-rated financial analysis software on G2 to compare solutions that fit your business model.

5 top line growth strategies to accelerate revenue

These strategies are designed to grow your gross revenue by acquiring new customers, increasing the value of existing ones, and building more resilient revenue streams.

1. Expand your customer base

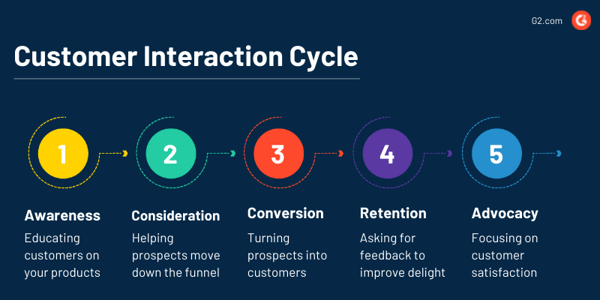

To fuel sustainable growth, begin by identifying your most profitable customer segments through CRM data, behavioral analytics, and customer journey insights. Once you have a clear picture of your ideal customer profile (ICP), expand your reach through a mix of paid advertising, SEO, content marketing, affiliate partnerships, influencer collaborations, and industry events. Test your messaging across channels and geographies, and don’t hesitate to localize campaigns when entering new markets or verticals. The key is to diversify your acquisition sources while maintaining relevance and precision in targeting.

2. Cross-sell and upsell

Increasing revenue from existing customers can be more cost-effective than acquiring new ones. Use customer data such as purchase history, engagement behavior, and feedback to recommend relevant add-ons or premium versions of your offerings. Well-timed upsell and cross-sell opportunities, introduced during onboarding, checkout, or renewal, can boost CLV without overwhelming users. Consider loyalty programs, bundling, or tiered pricing models to further incentivize increased spend and retention while making your offerings more attractive and accessible.

3. Launch new products or services

Introducing new products or services allows you to tap into unmet customer needs and open up additional revenue streams. Start by gathering insights from customer feedback, market trends, and competitor activity to identify gaps worth addressing. Develop MVPs or run beta programs to validate demand and refine features based on real-world usage. This can include adjacent product lines, enterprise-grade versions, or subscription-based services. A focused, feedback-driven launch strategy reduces risk and increases the chances of adoption and long-term profitability.

4. Strengthen marketing efforts

Effective, data-driven marketing is essential for customer acquisition and retention. Build detailed buyer personas, align messaging with the customer lifecycle, and personalize campaigns across digital channels. Use marketing automation to scale efforts and A/B testing to optimize performance. Segment your audience based on behavior or demographics and tailor content accordingly. By continuously tracking ROI, you can double down on high-performing channels and refine or eliminate those that underperform, maximizing the return on your marketing investment.

5. Create referrals

Word-of-mouth and customer advocacy are powerful tools for organic growth. Encourage satisfied customers to share their experiences by offering referral programs with clear incentives, such as discounts, rewards, or exclusive access. Make it easy for them to refer others through seamless tools and social sharing options. Collect testimonials and user-generated content to amplify trust, and consider co-marketing opportunities with partners that target similar audiences. A strong referral engine not only boosts revenue but also enhances brand credibility and loyalty.

5 bottom line strategies to maximize profitability

These strategies help improve your margins and cash flow by optimizing pricing, reducing costs, and increasing operational efficiency.

1. Adjust your pricing

Revisiting your pricing strategy can significantly enhance profitability by better aligning prices with the value you deliver. Instead of focusing solely on covering costs, assess what your product is truly worth to your customers. Conduct competitive benchmarking, gather customer feedback, and evaluate perceived value to uncover pricing power. Implement techniques like tiered pricing, bundling, and price anchoring to serve different segments while maximizing willingness to pay. If your offering consistently delivers strong results, many customers are willing to accept a higher price, especially when backed by improved features, service levels, or performance guarantees.

2. Focus on high-margin products

Shifting attention to your most profitable products or services can yield better returns with fewer resources. Start by analyzing your product portfolio to identify items with strong gross margins and scalable delivery models. Then redirect marketing, sales efforts, and operational focus toward promoting these high-margin offerings. Highlight their benefits through strategic positioning, upselling tactics, and value-driven messaging. Even if these products represent a smaller portion of total volume, they often contribute disproportionately to net profit and can be powerful levers for bottom line growth.

3. Get paid

Revenue only matters when it’s collected, so strengthening your billing and collections processes is key to maintaining healthy cash flow. Automate invoicing to ensure timely delivery, and clearly define payment terms in every contract. Offer multiple payment options, including digital and early-payment discounts, to encourage faster settlement. For larger clients, run credit checks and establish transparent expectations upfront. Consistently follow up on overdue payments with tactful reminders and escalate as needed. A disciplined collections process helps reduce bad debt and protects your revenue from slipping through the cracks.

4. Reduce costs

Improving your bottom line often starts with trimming unnecessary expenses, without sacrificing quality or customer satisfaction. Conduct regular audits of your cost structure, including vendor contracts, software subscriptions, utilities, and administrative overhead. Implement zero-based budgeting to ensure every dollar is justified, and challenge teams to find leaner ways to operate. Look for opportunities to outsource non-core functions, consolidate suppliers, or adopt hybrid work models that reduce facility costs. Strategic cost-cutting ensures you’re operating efficiently while preserving value delivery to your customers.

5. Automate everything

Automation is one of the most effective ways to streamline operations, reduce errors, and scale without adding headcount. By identifying repetitive, manual tasks across departments, such as email outreach, payroll processing, CRM updates, or inventory tracking, you can deploy automation tools that save time and resources. In addition to process automation, leverage AI tools for lead scoring, customer support, content generation, and data analysis. The result is greater efficiency, faster decision-making, and more bandwidth for strategic work, all of which improve your cost structure and bottom line.

More than your average newsletter.

Every Thursday, we spill hot takes, insider knowledge, and news recaps straight to your inbox. Subscribe here

Top vs. bottom line: Frequently asked questions

Q. Can a company grow its topline but still have a declining bottom line?

Yes, this is common in cases of overexpansion, high operational costs, or aggressive discounting. If the cost of generating revenue outweighs the gains, net income may shrink even when sales are up.

Q. Is topline growth always a good thing?

Not necessarily. While topline growth can indicate strong demand, it needs to be evaluated alongside the bottom line. Growth that comes at the cost of high debt, razor-thin margins, or operational inefficiencies may hurt long-term viability.

Q. How do I balance short-term profitability with long-term growth?

A healthy business model doesn’t choose one or the other; it plans for both. Short-term profitability can fund long-term innovation, and revenue growth builds valuation and market presence. If you’re choosing between the two, use metrics like payback period, CAC:LTV ratio, and gross margin to model sustainable growth paths. Tools like cohort analysis or forecasting can help align your leadership team.

Q. What role does pricing play in affecting both top line and bottom line?

Pricing directly influences both revenue and profit. Higher prices can boost the topline if sales volume stays steady, but poor pricing can lead to churn and lost sales, hurting both metrics. Smart pricing strategies help maximize growth and profitability.

Q. Best accounting software for small businesses

QuickBooks Online is a top-rated accounting software for small businesses on G2. It is praised for its ease of use, invoicing, expense tracking, and reliable financial tools.

Line up growth

Top and bottom line growth aren’t competing goals; they’re two sides of building a resilient, scalable business. Focusing only on revenue without managing costs can erode profits, while obsessing over efficiency without expanding sales can stall momentum.

The smartest companies align both. They invest in growth strategies that drive revenue, like launching new products, upselling, and entering new markets, while simultaneously optimizing operations, pricing, and cost structures to strengthen profitability.

When you consistently monitor and improve both metrics, you’re not just growing, you’re growing with intention.

Too many metrics, not enough clarity? Focus on the sales KPIs that actually move the needle.

This article was originally published in 2020 and has been updated with new information.