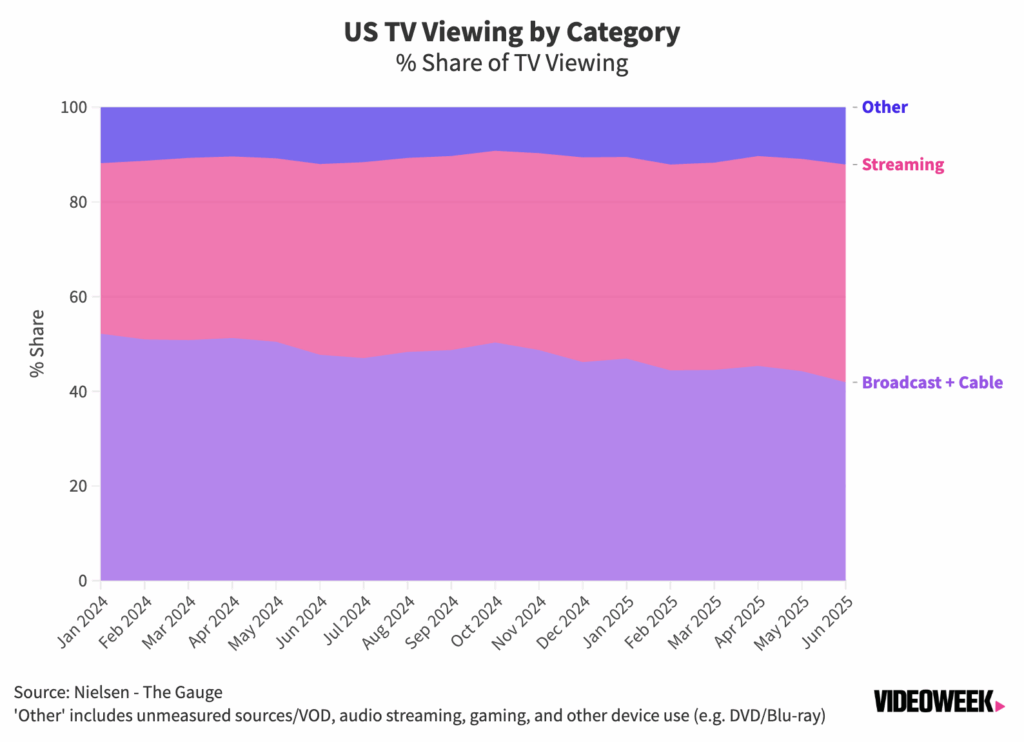

Streaming viewership in the US took another chunk out of broadcast and cable’s share of viewing last month, according to Nielsen’s latest ‘The Gauge’ report, with streaming accounting for 46 percent of total TV usage in June.

The report partially attributed the decline in broadcast and cable viewership to the “summer lull in traditional television viewing”, bringing their combined viewing share to 41.9 percent.

But Nielsen said the growth of streaming was predominantly driven by Netflix, whose viewing share was up 13.5 percent over May. The streaming giant saw particularly strong viewing for its returning original series Ginny & Georgia and Squid Game, as well as its acquisitions Animal Kingdom and Blindspot.

The streaming ceiling

However, Nielsen’s data shows that while Netflix viewing was up on the previous month, it actually declined compared to June last year. The streaming service was responsible for the top streaming title once again, but Ginny & Georgia‘s 8.7 billion minutes fell short of Bridgerton‘s 9.3 billion in June 2024.

At the same time, the rise of rival streaming services – both paid and free – have eaten into Netflix’s share of viewing. Amazon Prime Video, Roku, Tubi and Peacock have all seen year-on-year gains, while Netflix, Disney+ and Hulu have lost ground amid the plethora of streaming options in the US.

And the main source of competition for the SVOD services remains YouTube, which continues to grow its lead as the most-watched streaming service on TV in the US. The Google-owned video service took 12.8 percent share of total TV viewing last month, up from 9.9 percent in June 2024.

Squids in

Looking at TV viewing in the UK, a slightly different picture emerges. Netflix’s share of viewing has grown over the past year, according to Barb data, accounting for more than 10 percent of total TV viewing in June 2025. By way of contrast, Netflix’s viewing share in the US during June was 8.3 percent.

This is partly a reflection of the broader range of streaming options in the US compared to the UK. Barb measures Netflix, Disney+, Prime Video and Paramount+ as individual streaming services, half the number that Nielsen tracks in the US.

And while streaming viewing has overtaken broadcast and cable viewing in the US, broadcaster viewing continues to hold the majority of TV usage in the UK, accounting for 58.10 percent of total viewing in June. However, Barb’s measurement of broadcaster viewing includes the broadcaster-owned streaming (BVOD) services, which means iPlayer, Channel 4 and ITVX contribute to the broadcast total.

Considering the accessability of those free BVOD options, Netflix’s 10 percent share is a significant proportion of UK viewing. The streaming giant also entered Barb’s top 50 most-watched shows in June, when Squid Game returned to the streaming service at the end of the month.

It is still relatively rare for streaming titles to build audiences large enough to compete with those on BBC and ITV. In the first half of 2025, SVOD titles made up 3.38 percent of the total shows in Barb’s weekly top 50 charts.

Netflix content entered the charts 25 times during H1, most notably when Adolescence became the most-watched show in the UK, a first for a streaming title. Meanwhile Amazon Prime Video has made 18 appearances, including Clarkson’s Farm and Last One Laughing UK. Disney+ has entered the top 50 only once so far this year, when Moana 2 was released on the streaming service in March.

Follow VideoWeek on LinkedIn.